Image credits: Austin Distel on Unsplash

Traditionally, Wall Street is the natural habitat of suited and booted traders. But the events of last month proved that it is no longer the case – and the trading floor a digital space.

Thanks to technology and the internet, we are witnessing the uprising of small investors and “everyday traders”. In a surprising move, a group of them made global headlines after joining forces on Reddit to buy shares of GameStop and disrupting the stock market – without ever leaving their homes. Perhaps unsurprisingly, Gen Z are a driving force behind this phenomenon and as the New York Times reports, they are using social media platform TikTok to swap financial tips. On top of that, Cryptocurrency presents a major investment opportunity. Given that one Bitcoin is worth nearly $48,000 at the time of writing, many financial app adopters are looking to get a slice of the pie.

As seen from the steady rise of finance apps throughout the last year – from crypto/wallets and trading, through to mobile banking and investment – we have entered the era of finance democratization, spurred even further by COVID-19 global lockdowns and socio-economic instability.

This major shift presents a huge opportunity for performance marketers in the finance apps vertical. So, how can they acquire and engage mobile users in 2021? Let’s break down the trend and look at the most popular apps and consumer behavior, to apply key learnings for further growth.

Overview – Mobile is the top channel for influencing user decisions in finance

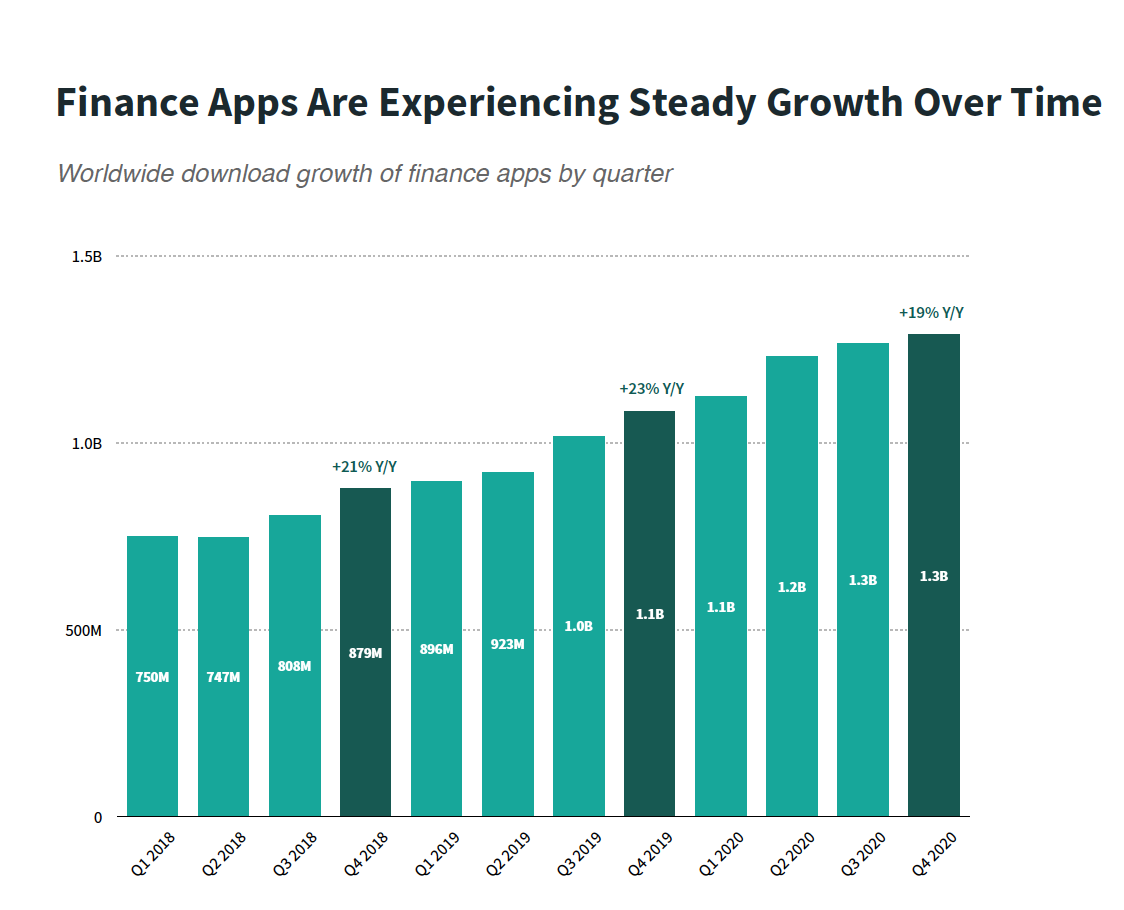

In 2020, finance app download growth remained strong globally, as consumers leveraged their mobile devices for all their financial needs – driving high demand and rendering financial apps a critical part of the decision-making process: from research to consideration, evaluation, and purchase or investment. In 2020, finance apps accumulated nearly 5 billion downloads worldwide at a growth rate of 25% year-over-year (YoY), Sensor Tower shared.

When looking at a yearly growth since 2018, finance apps were up 19% YoY in Q4 of 2020.

Time spent in-app also increased by 45% globally (excluding China, where new legislation in the peer-to-peer lending space led to a decline), App Annie reports.

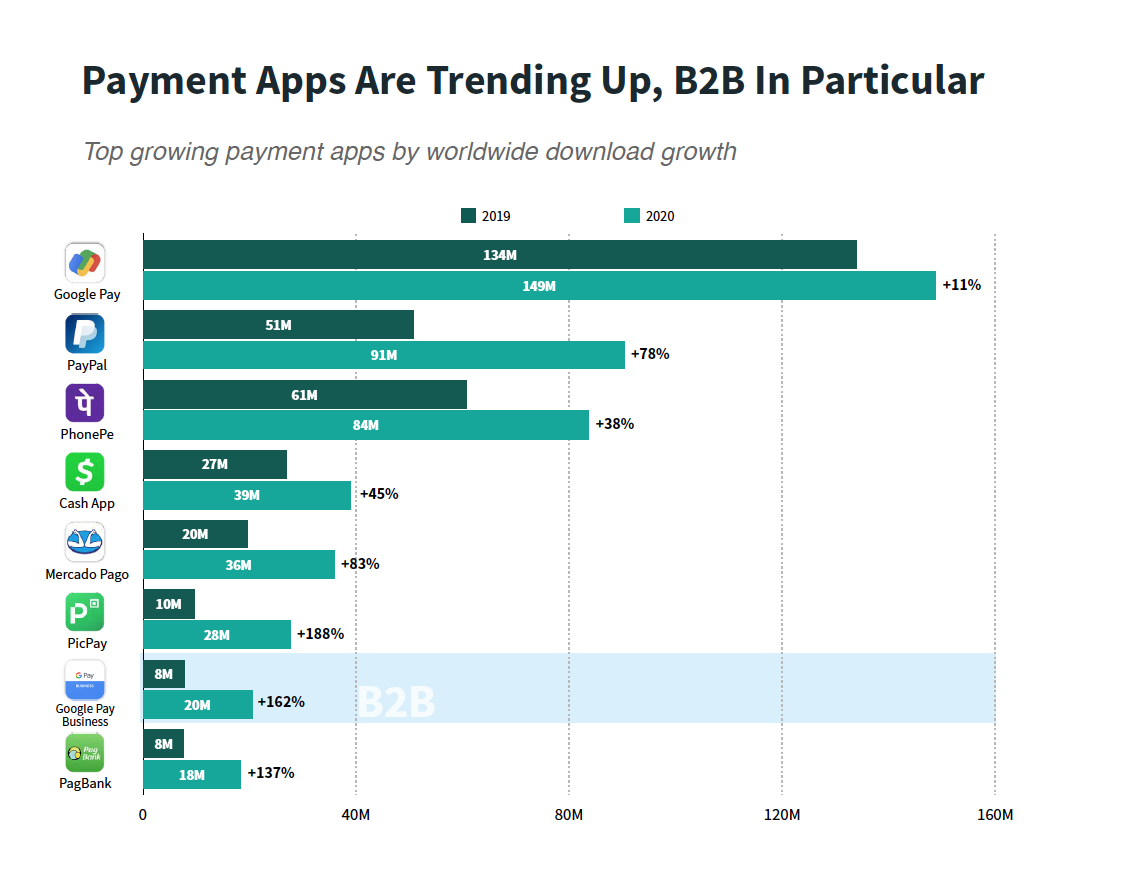

Adoption in this vertical was led by payment apps including Google Pay and PayPal, ranking number 1 and 2 in the global download charts.

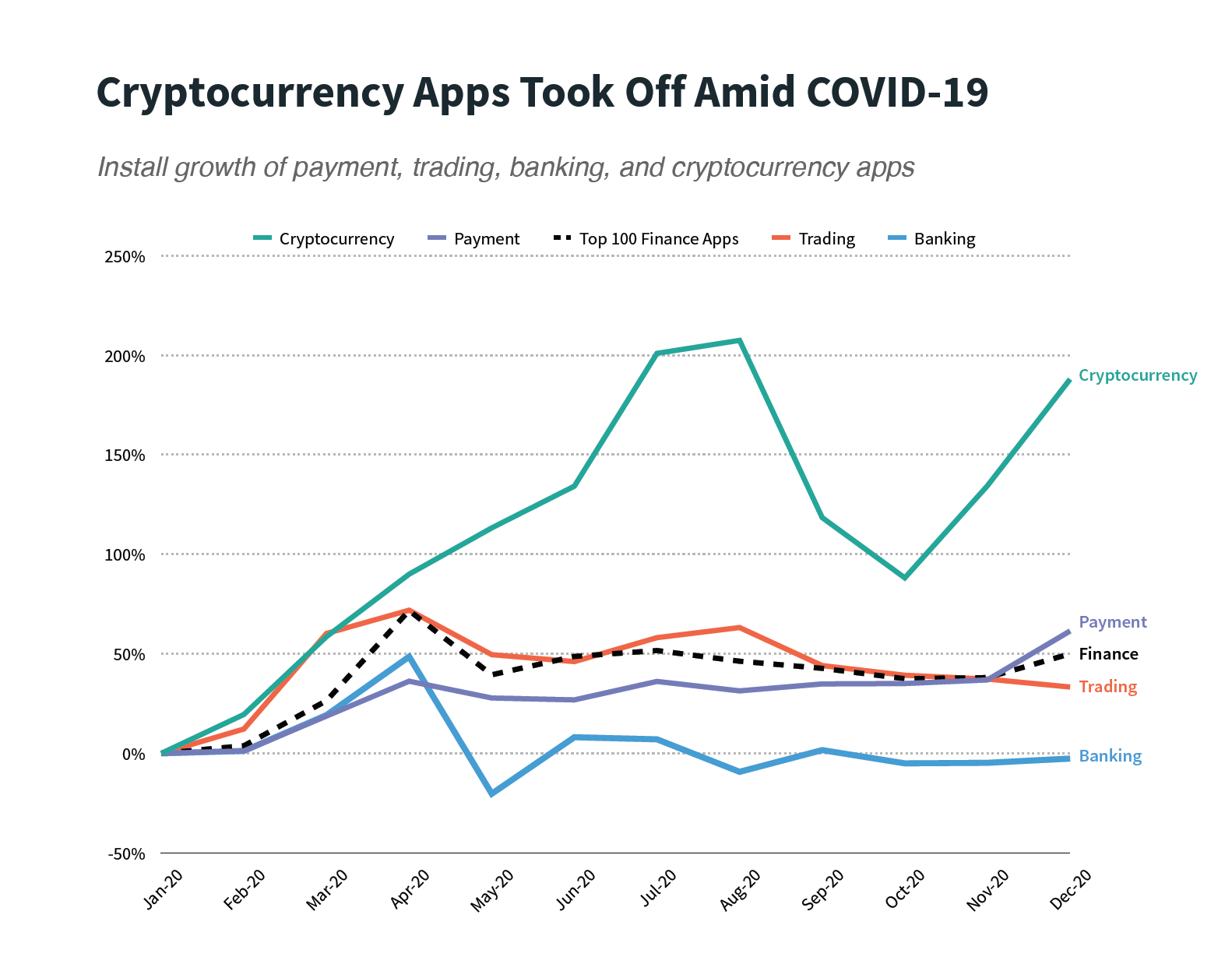

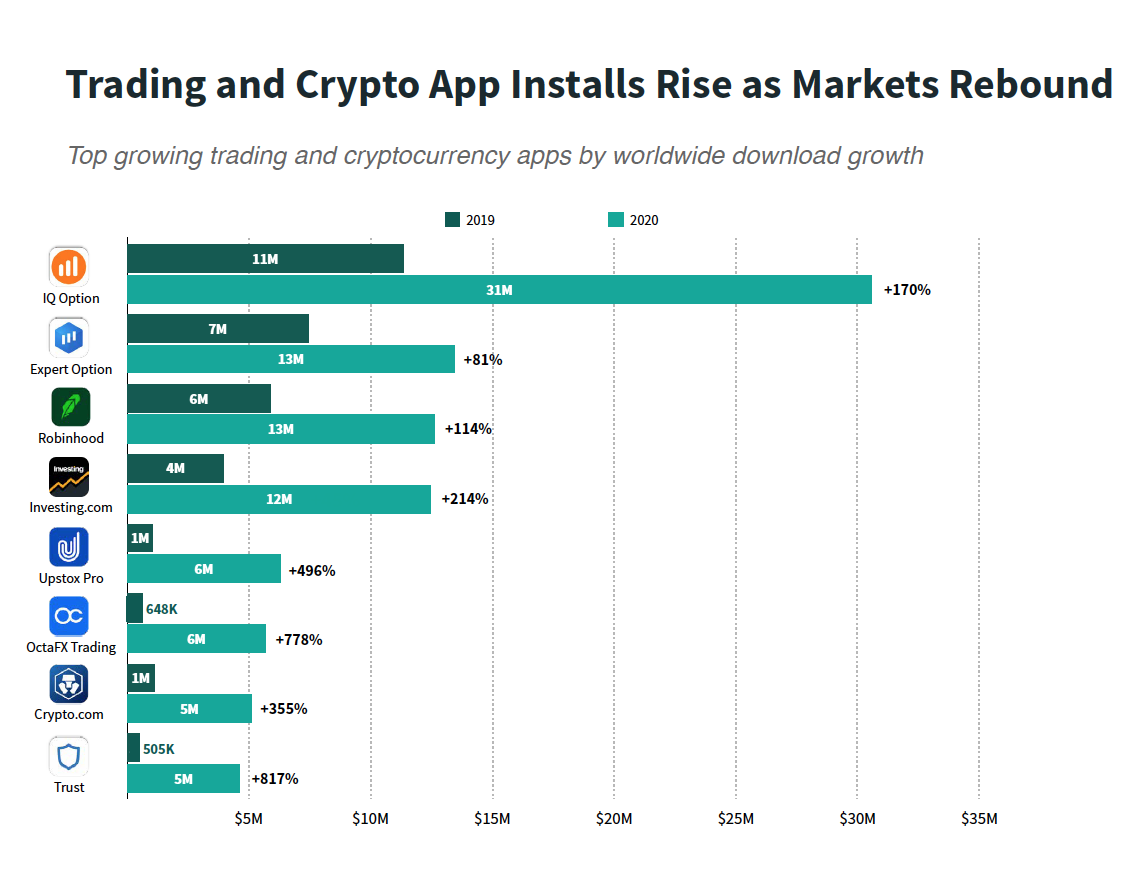

However, Cryptocurrency apps are the fastest-growing in this sector, as seen in the graph above (Sensor Tower). Both stock trading and cryptocurrency apps continue to see high volume in demand.

To simplify the broad area of fintech apps, we’ll break financial app sub-verticals into 2 main categories:

- Trading apps (including Crypto)

- Financial management and service apps (banking, mobile payments,), etc.

1. TRADING APPS

- Asset Management Apps (aka Investment and Trading) reach new ranks

In the wake of a tumultuous financial year with rising debt, unemployment, and a global recession, mobile users are increasingly looking to build alternative revenue sources and invest in capital.

Apps with a focus on investing or saving – Robinhood, Acorns, and TD Ameritrade – have been steadily growing, bringing trading to the masses and empowering these financially.

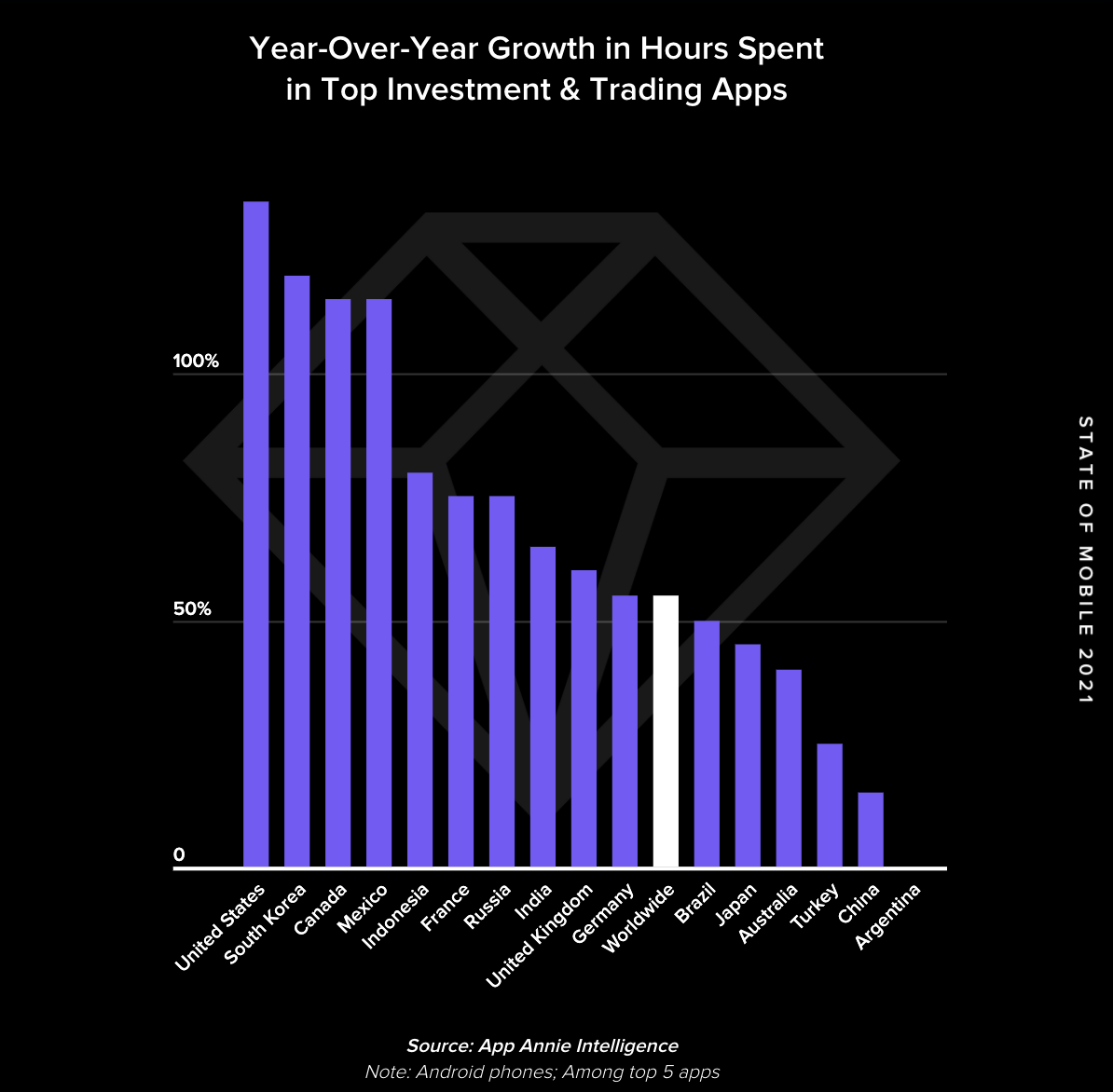

In fact, App Annie estimates that in 2020, participation in the stock market on mobile grew by 55% globally.

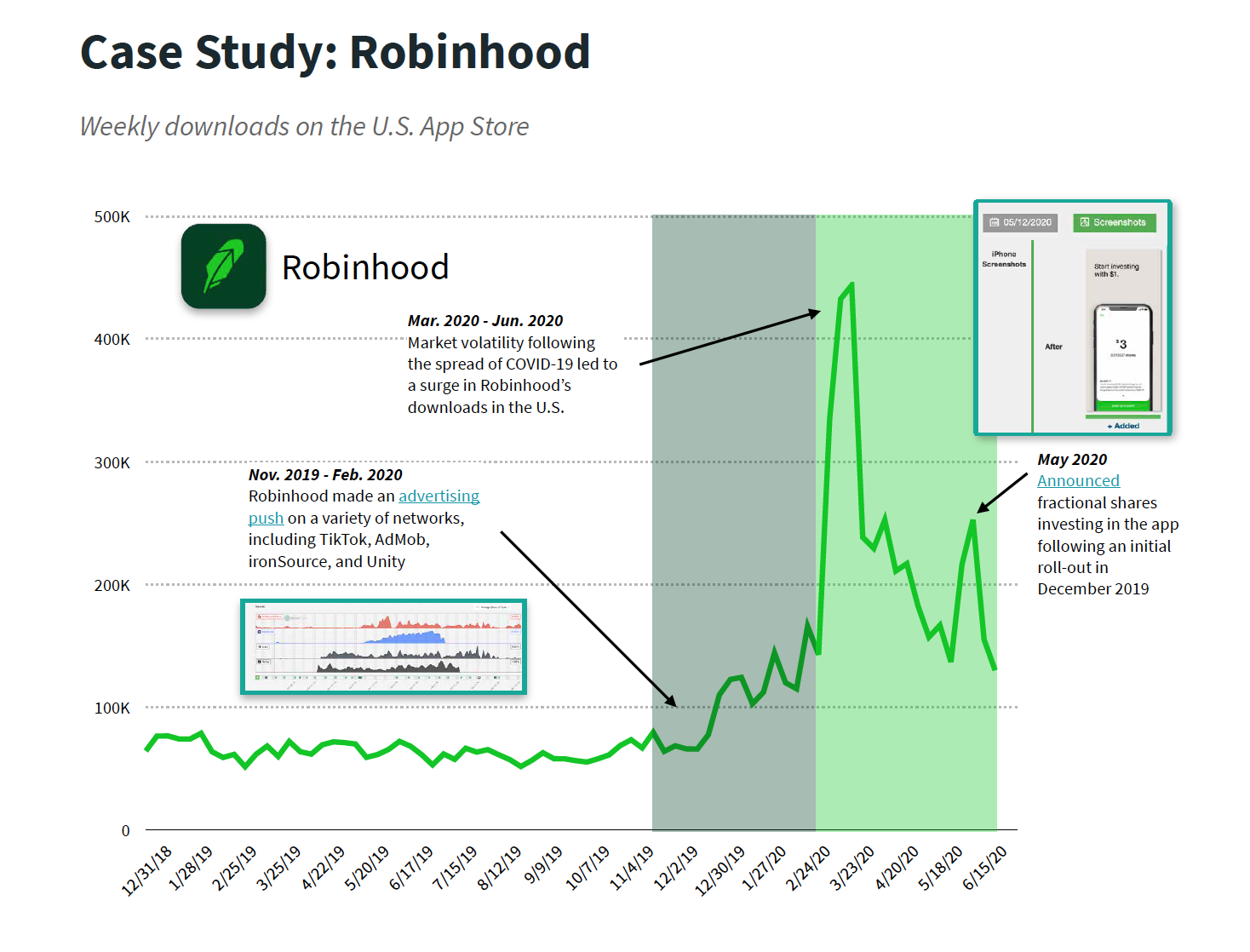

Let’s take a closer look at Robinhood. In the US, the app saw huge downloads in the first half of 2020, which corresponded with an advertising push on networks including AdMob, ironSource, and TikTok. This was a timely move, considering the stock market dip around COVID in March 2020 – which led to over 400K downloads in a matter of weeks.

Globally, IQ Option and Expert Option were the top two trading apps by downloads in 2020. IQ Option came out on top, with a total of 31 million downloads and YoY growth of 170%.

Other top trading apps such as Upstox Pro and OctaFX Trading were popular in APAC markets in India, Indonesia, and Pakistan. Trading app Kite Zerodha was India’s biggest finance app by time spent, up 140% on Android (App Annie).

- Crypto/Wallets Apps are among the fastest growing in the finance mobile sector

Speaking of investments, let’s talk Crypto.

No longer just the domain of programmer nerds as in the early days (some of whom may have become millionaires by now), cryptocurrency apps make it easier for anyone to buy, sell and hold cryptocurrencies (known as “managing their portfolio”). Mobile apps have easier setup and login features than desktop versions, making them more user-friendly and less intimidating.

Cryptocurrency apps downloads spiked following the outbreak of COVID-19, rising to more than 200 percent in August 2020 compared to January (corresponding with record cryptocurrency trading volumes), Sensor Tower shared.

Bitcoin may be the most hyped cryptocurrency, but there are a myriad of crypto-trading apps on the market, such as eToro, Gemini, Voyager, and Coinbase. In 2020, Crypto.com and Trust saw their installs more evenly distributed across many countries globally. Binance rose through the ranks in Argentina and Russia, while Bitso became number one in Mexico (App Annie).

In a year of mass state borrowing, many consumers saw cryptocurrency as an attractive store of value to fiat money. With some experts saying one Bitcoin could surpass $300,000 in value in the coming years, we expect that this category of Finance apps will continue to grow too.

2. FINANCIAL SERVICES APPS

- Mobile Banking Apps soar for convenience and health safety reasons

Mobile banking apps are just one part of the wider revolution in mobile finance, which also includes digital payments and loans. As early as 2018, consumers were accessing their banking apps on average once a day — creating entirely new behavior and disrupting traditional banking models.

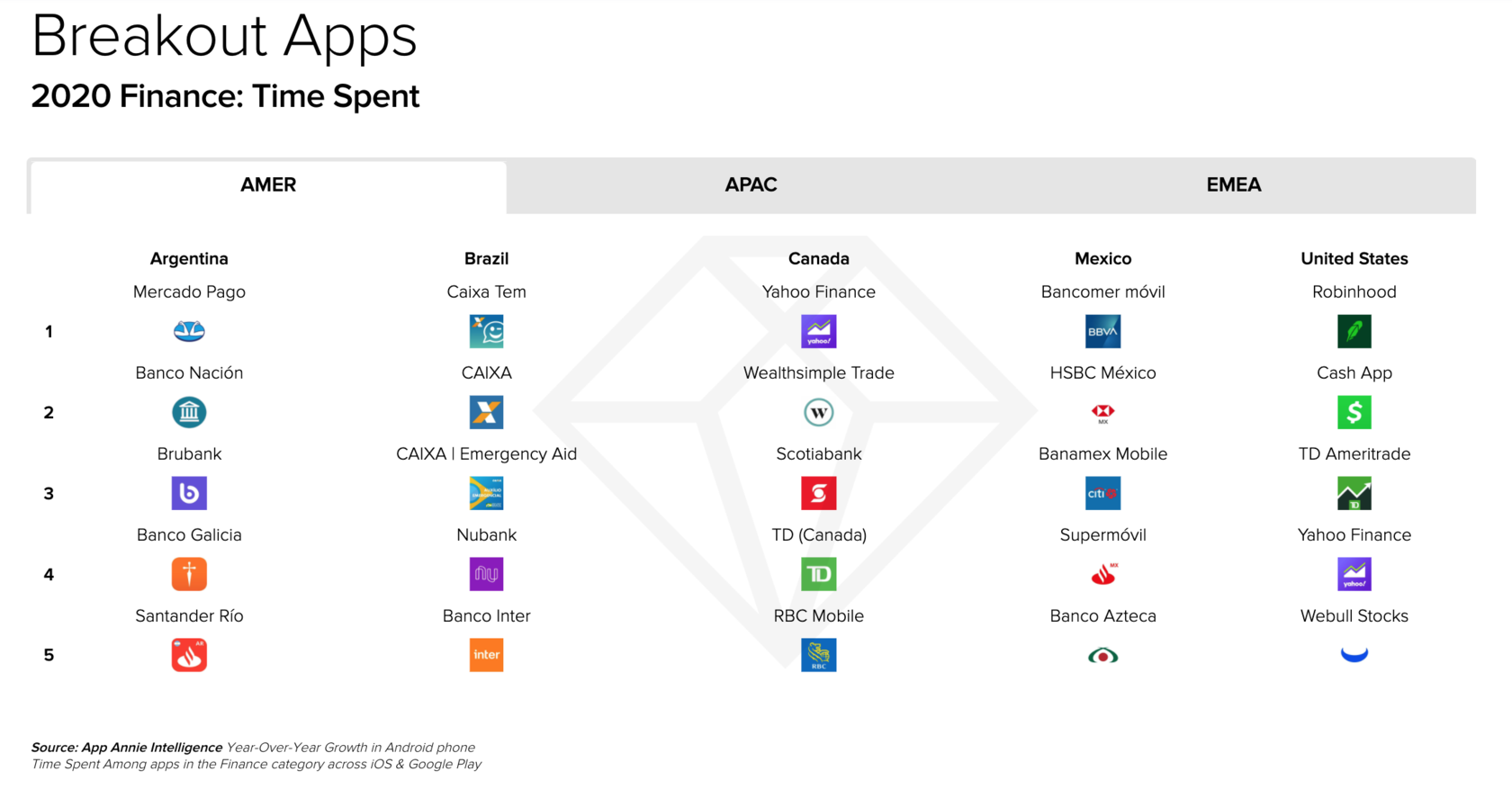

On top of convenience, safety became the key driver in 2020. With lockdowns preventing access to physical branches, banks like Caixa and HSBC were “breakout apps” and showed a record in time spent (App Annie) in LATAM countries Argentina, Brazil, and Mexico.

- Mobile Payment Apps are on a steady rise, with B2B driving growth

This category includes apps to send and receive money, such as Venmo, Cash App, and PayPal.

With the use of cash posing a hygiene risk, contactless mobile alternatives have experienced record-breaking growth. Last year, both consumers and retailers adopted mobile payment apps – including contactless or QR code payments – including in slow adopting markets like the US.

This major shift will continue to drive growth. A Visa study found 39% of SMEs now accept new digital forms of payments – and 74% expect consumers to continue with contactless payments even after a vaccine.

Google Pay for Business, a business-to-business payment app, was up 162% YoY at number 1. PayPal and PhonePe were the top growing payment apps by YoY growth, accounting for 40 million and 23 million downloads respectively. PayPal had at least 2 million downloads in 10 different countries, while 99 percent of PhonePe’s installs were from India. Both Google Pay and PhonePe saw major growth for their B2B versions.

Other breakout finance apps in this category in APAC are Tez in India, and PayPay in Japan, by growth in time spent on Android phones.

- Payment Solution Apps are big in APAC and disrupt the conventional loan model

Payment solution apps such as Klarna, Afterpay, and Affirm allow shoppers to “buy now, pay later”.

In the credit space, quick and short-term loans have become a necessity during the economic crisis, leading many people and small businesses to avoid bureaucracy. Apps for peer-to-peer loans rose in Indonesia and India in 2020, where traditional loan companies are hesitant to provide loans. Given that many unemployed people are unable to commit to repayment terms, these personal loan apps have introduced a viable alternative.

Buy now, pay later, or “reverse credit” apps also popular among zoomers and millennials in the US and Australia.

Conclusion

- The volatile stock market and economic recession have led to an increased usage of trading and investment apps, which are in record-breaking growth.

- Digital banks are growing in market share and disrupting the traditional banking model. As physical locations remain closed and physical contact is limited, mobile users will continue to monitor their finances digitally, and payments will continue to be made virtually.

Takeaways: What can fintech performance marketers learn and apply to drive growth?

The fintech industry is in a critical stage of innovation, and it’s up to performance marketers to beat the array of competition – and continue driving this mobile-first growth forward. Here are our tips:

- In this hugely unpredictable climate, user data is evolving on a weekly, if not daily, basis. Any pre-COVID trends are now obsolete, so mobile advertisers should stay on top of campaign data and understand it deeply to keep up with consumers’ mindset.

- In the US, 28% of finance apps suffer from more than 30% install fraud rate – so invest heavily in anti-fraud tools and monitor campaigns carefully (AppsFlyer).

- It’s a competitive market that requires a significant budget. AppsFlyer shared that in the US, nearly 1 in 2 finance app installs in 2020 was non-organic, as marketers increasingly boost user acquisition budgets to stay competitive. Finance apps with a marketing budget saw a 70% lift in share YoY.

- Staying informed of industry and user trends is vital to make strategic campaigns and stay ahead of the competition. We hope that with the help of this blog post, you’re well on your way!

Are you looking for support to grow your fintech app and manage your mobile advertising campaigns? Drop us a line at partners@apptrust.io.

Author: Elizabeth Marchetti

apptrust