Image credits: Ketut Subiyanto on Pexels

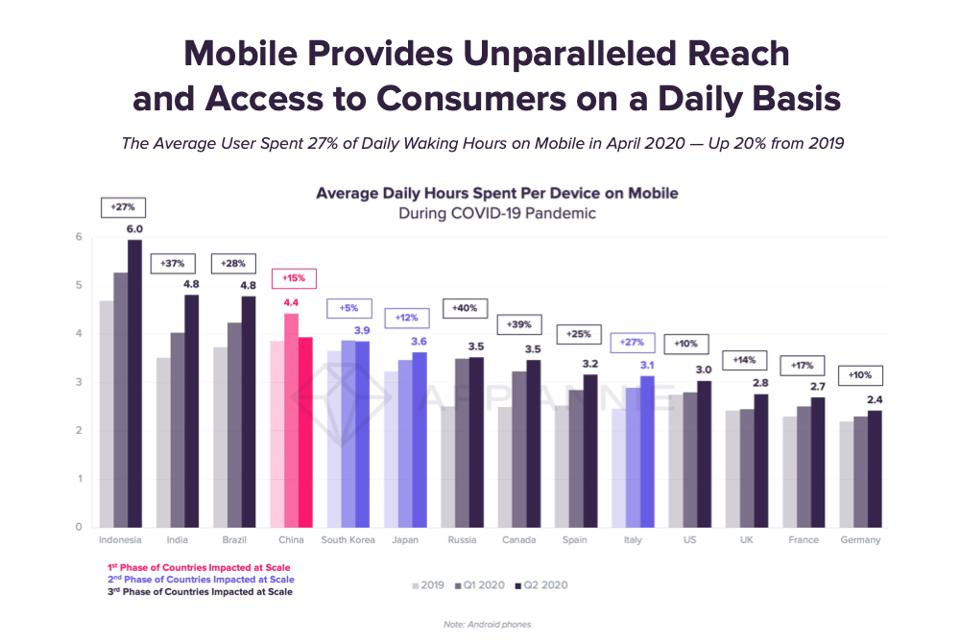

As the year 2020 comes to a close, we see that Covid-19 has not only dramatically impacted life as we know it, but it has also irreversibly changed mobile user behaviour, speeding up device adoption and usage globally (to learn more, read our Q1 and Q2 mobile app trends reports here).

With a new year on the horizon, we ask – what is the current state of mobile apps and how can performance marketers navigate the challenges of this mobile-first world to leverage its exciting opportunities?

Take a look at the top 5 mobile app trends that have shaped 2020 to help you sharpen your campaign-planning skills into 2021.

Key mobile user behaviours of 2020

- People spend more than 5 hours a day on mobile – collectively 1.6 trillion hours (App Annie)

- Consumers spent 25% more on mobile apps than ever before: $50 billion in the first half of the year (App Annie)

- Global app downloads reached 36.4 billion in 3Q20, an increase of 22.8% YoY (Sensor Tower).

- Mobile accounts for approximately half of the web traffic worldwide. In Q3 of 2020, mobile devices (excluding tablets) generated 50.81% of global website traffic (Statista).

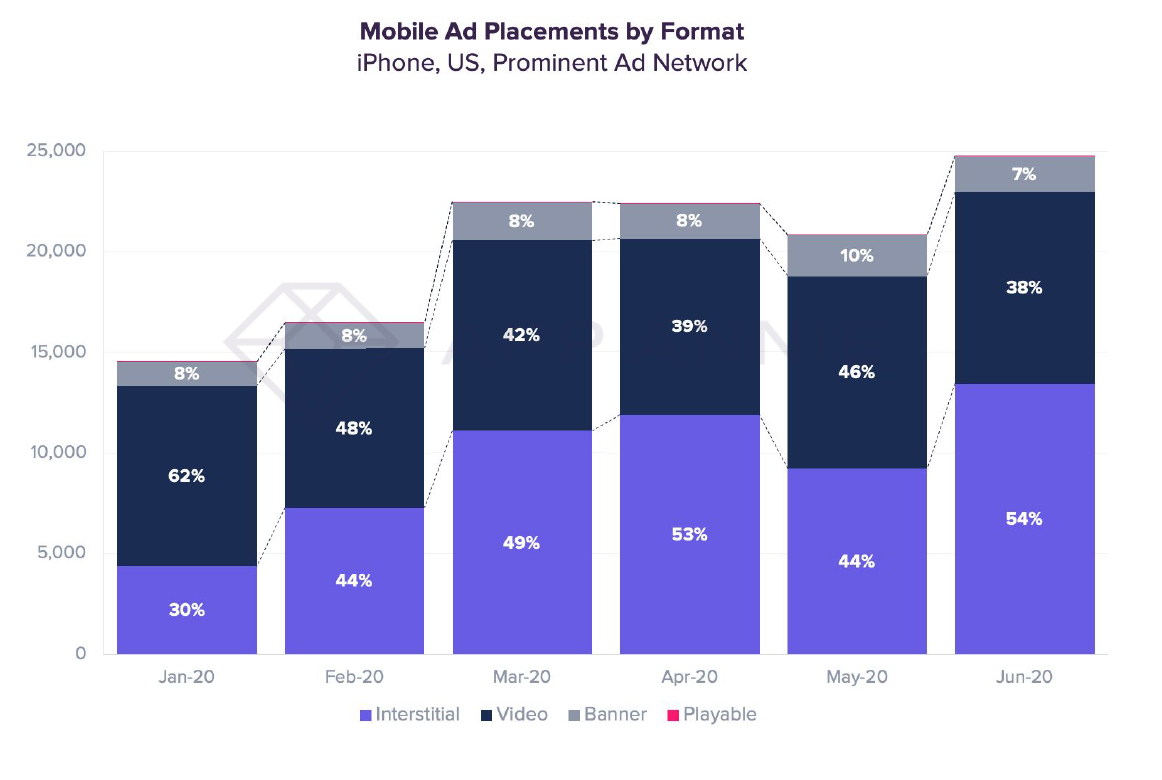

- Despite reductions in marketing budget, mobile’s unparalleled reach and engagement is spurring strong growth in mobile ad placements, App Annie shared. For a major US ad network, mobile ad placements jumped 70% in the first half of the year (App Annie) driven by interstitial ads, up 205%.

Top 5 Mobile App Trends of 2020

- Record-breaking Singles Day 2020 confirmed eCommerce’s boom

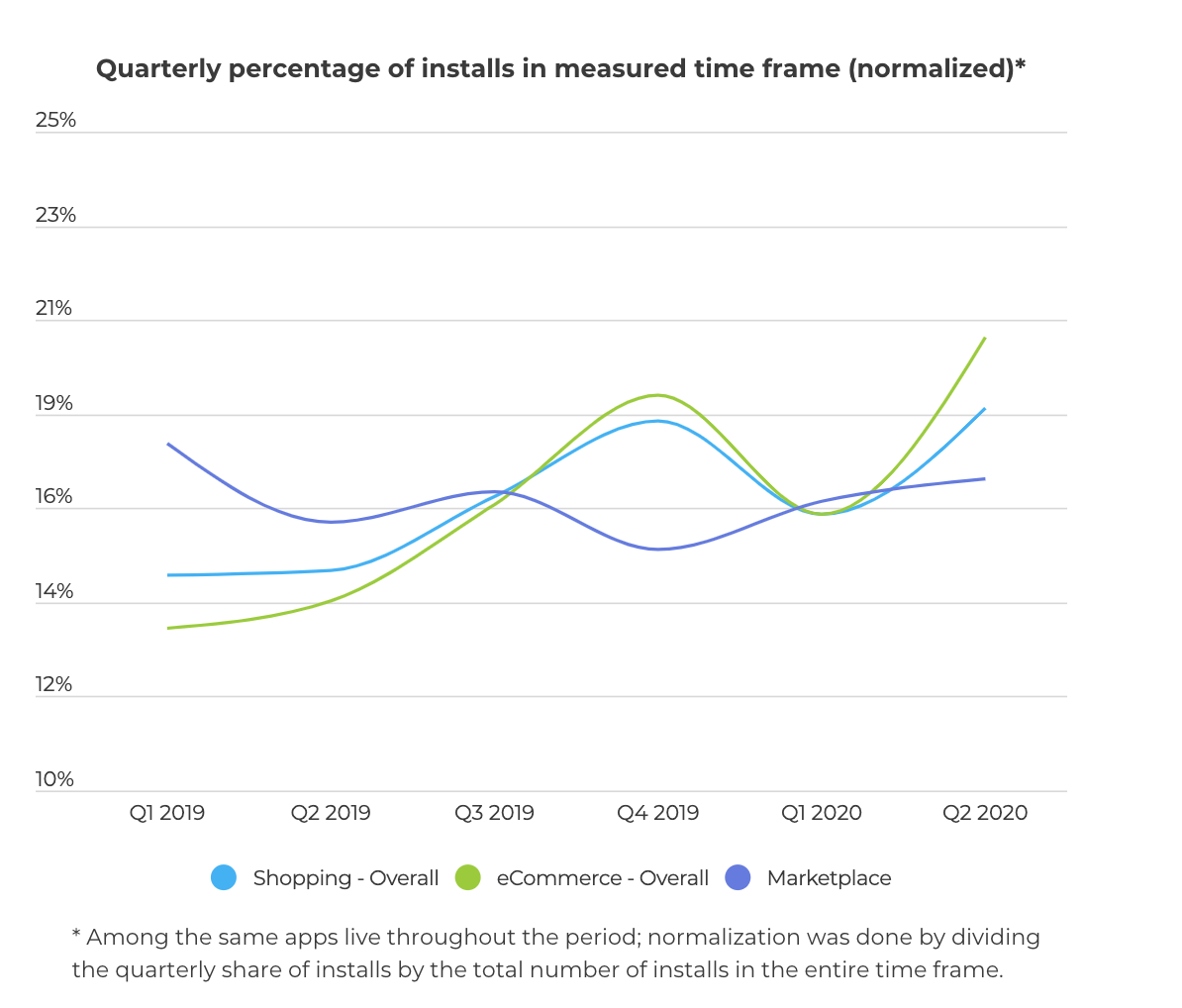

More people are buying online for the first time. Driven by Covid-19 lockdowns, eCommerce boomed in H1 2020, achieving growth that would have normally taken between 4 and 6 years. Globally, eCommerce app installs rose by 25% during the pandemic (Q2 vs. Q1 2020) and were 7% higher than the Q4 holiday rush (AppsFlyer).

As predicted in our recent blog post, the 2020 holiday season further cemented eCommerce success due to shoppers avoiding crowds, and online retailers aggressively extending their discounts to encourage purchase in economically uncertain times. This resulted in a record-breaking Singles Day in China, with eCommerce giant Ali Baba generating an unprecedented $74.1 billion in sales – up 26% from last year. They processed 583,000 orders per second during peak activity, during an 11-day promotional period.

Meanwhile, in the US, Cyber Monday led to a record-breaking $10.8 billion in sales – the biggest online sales day in US history, Market Watch reports. Mobile accounted for 37% of those sales – likely boosted by mobile marketers who spent 60% more during the holiday season for fashion apps, compared to the average spend per month (App Annie).

As seen in the chart, global app install ad spend among Shopping apps generated $6 Billion in 2020 and accounted for 60% of the total spent in user acquisition campaigns in North America (AppsFlyer). The UK also showed a similar trend.

With mobile users in the US spending 1 billion hours in shopping apps in Q4 2020 (a 50% YoY increase) and consumers worldwide shopping mostly on apps like SHEIN, Flipkart, Wish and Amazon shopping (Statista), it is critical for brands to invest in mobile. With up to 90% of shoppers claiming their experiences of shopping on mobile could be better due to functionality and safety concerns, app developers should prioritize features that resonate with users’ remote shopping and socially distant needs. Mobile marketers should continue to leverage deals and promotions during key calendar times.

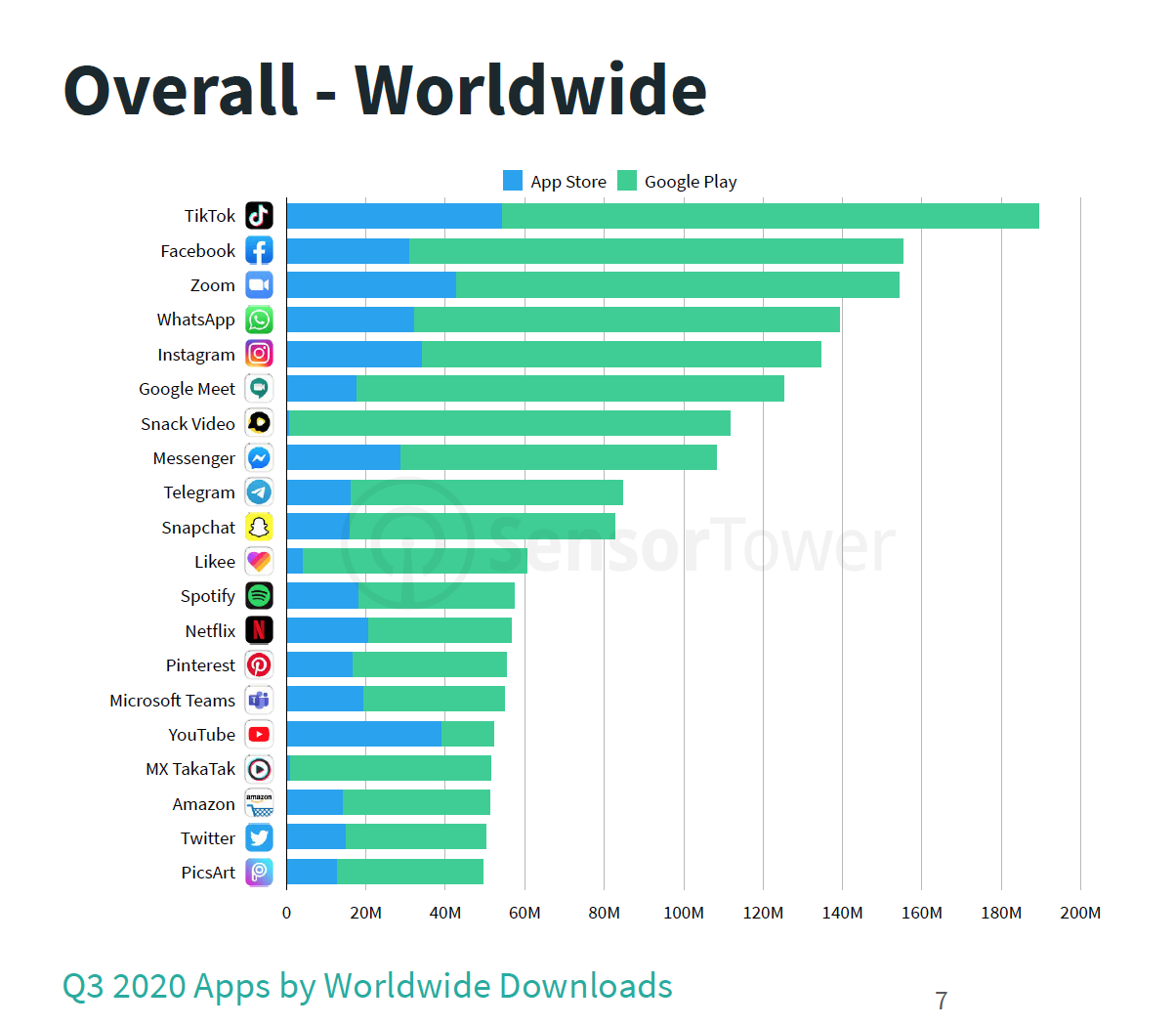

2. TikTok led social media apps growth – and generated the highest controversy

Unsurprisingly due to social-distancing measures, mobile users hugely adopted social apps, topping global downloads (Sensor Tower). In November 2020 WhatsApp was the most downloaded non-gaming app with nearly 58 million installs, followed by TikTok at 55 million, and Facebook.

TikTok is not just the fastest-rising social platform, but a phenomenon that has captured the cultural zeitgeist of gen Zs globally (hello, TikTok challenges!) and courted controversy, positioning China’s government under scrutiny over its handling of user data.

While the White House threatened to ban TikTok in the US, India’s government banned the app in June along with 59 other Chinese-made apps – including Shein, Shareit, Clash of Kings, Kwai and Likee – citing national security concerns and following border disputes with China. This was a big loss for TikTok, which counted 610 million downloads and 600 million active users in India —about 44% of the whole population; twice as many users than the US and amounting to over a quarter of global downloads.

Nonetheless, in Q3 TikTok remained the highest-earning non-game app globally across all stores, followed by YouTube which grew 59 per cent YoY in revenue.

Clearly, this shows that short-form video is the winning format for social apps and the most viral. With 72% of consumers saying they prefer to learn about a product, service, or influencer through video content instead of text or image marketing combined (NeoReach), mobile advertisers must look for holistic and engaging ways to implement creative video ads in their campaigns to stay ahead.

3. Fintech and Business Categories Performed Well in Economic Uncertainty

Fintech continues to disrupt traditional banking models in 2020. PayPal (who also owns Venmo) reported Q2 as its best-ever, with total payment volume up by 29% YoY and earnings per share by 86% in Q2 2020 (App Annie) – which can be linked to a combination of the rollout of QR Code technology in 28 global markets and touchless payments features, as well as the launch of commercial partnerships.

Another app that boomed, led by remote-working pandemic needs, is Zoom – the most downloaded worldwide in Q2, briefly surpassing TikTok. It was the only app to reach 300 million installs in a quarter, other than TikTok and Pokémon GO (Sensor Tower). In fact, mobile users spent most of their time on video conferencing apps in Q2, with the top 5 being Zoom, Microsoft Teams, Google Meet and Cisco Webex Meetings.

Mobile advertisers across the board must continue to find new ways to leverage the rise of user time spent on mobile in 2020.

4. Mobile gaming is booming globally, led by the US and China

The category continues to grow at an unprecedented rate, with smartphones playing a significant role in this expansion. Location-based games, cloud gaming, blockchain-based games, AR/VR enabled mobile games, are also fueling the demand for mobile games.

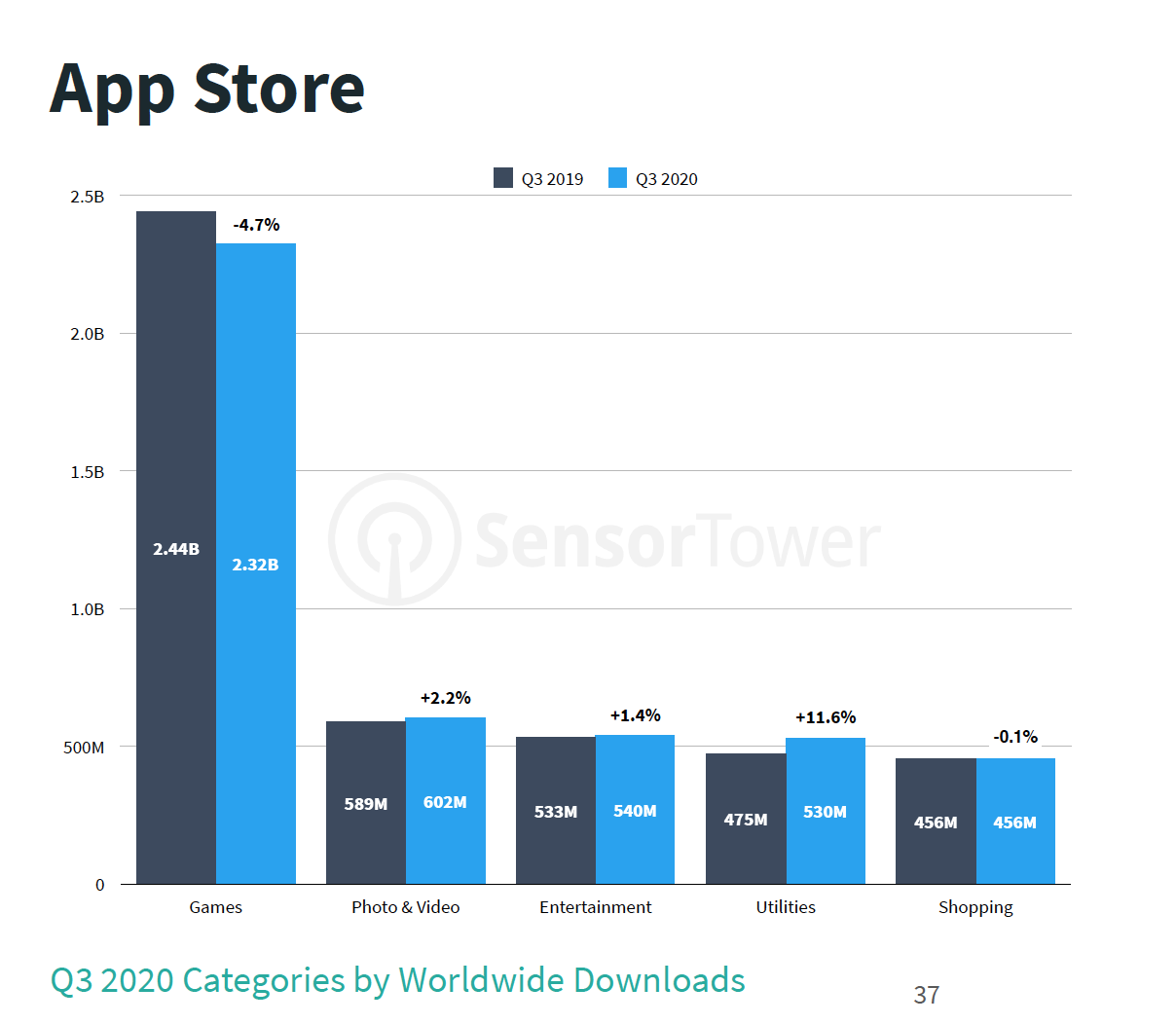

In 2020, mobile games outperformed all other categories globally in downloads and in-app spend, led by China and the US; and followed by Africa, the Middle East, and Latin America.

In Q2, revenue for mobile games in the US surpassed $6 billion for the first time, with a 55% YoY growth; and earned $5.8 billion in Q3, led by Simulation (59%), Casino (51%), and Shooter (49%) games, followed by Puzzle, Strategy, and RPG. Top games in Q3 were Coin Master, Candy Crush Saga and Clash of Titans.

APAC will continue to lead growth until 2025, predicts Research and Markets. The region benefits from the influence of China – a major developer hub and home of Tencent Holdings Ltd. – and its access to 5G networks and cloud-gaming, allowing instant play options on smartphones to rival console-quality. India, one of the fastest-growing smartphone markets, is also one to watch.

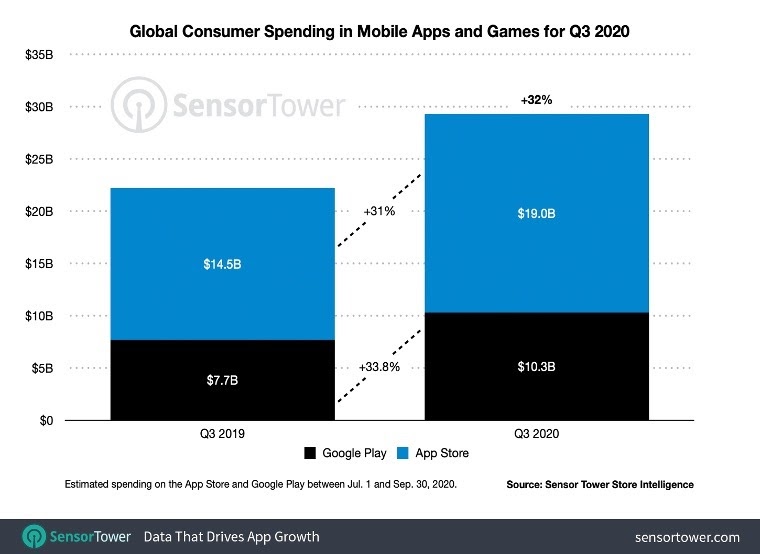

In Q3 mobile games reached $29.3 billion in in-app spending globally (in-app purchases, subscriptions, and premium apps) and gained 36.5 billion installs on all app stores – a substantial increase of 32% QoQ (Sensor Tower).

Gamers like to play on their device throughout the day, so mobile marketers should continue to target this highly engaged, active and responsive user group with the right ads and creatives. Hungry for new experiences, mobile gamers are used to seeing ads and are more willing to engage with them than other user groups – especially in the form of rewarded video ads.

5. Travel Vertical and Sports Suffered Losses, but sports made a comeback

The global tourism industry lost $460 billion due and 440 million international arrivals due to Covid, the UN shared. Aptly, Forbes deemed 2020 “a lost year for travel”, with air travel in the US down 45% since January and hotels being only half full.

However, the summer of 2020 saw a slight uplift in travel apps, due to Covid travel restrictions easing up – marking a 30% growth between the months of June and August, compared to Q1. Top apps show consumer interest in accommodation, travel planning and map/navigation features (App Annie).

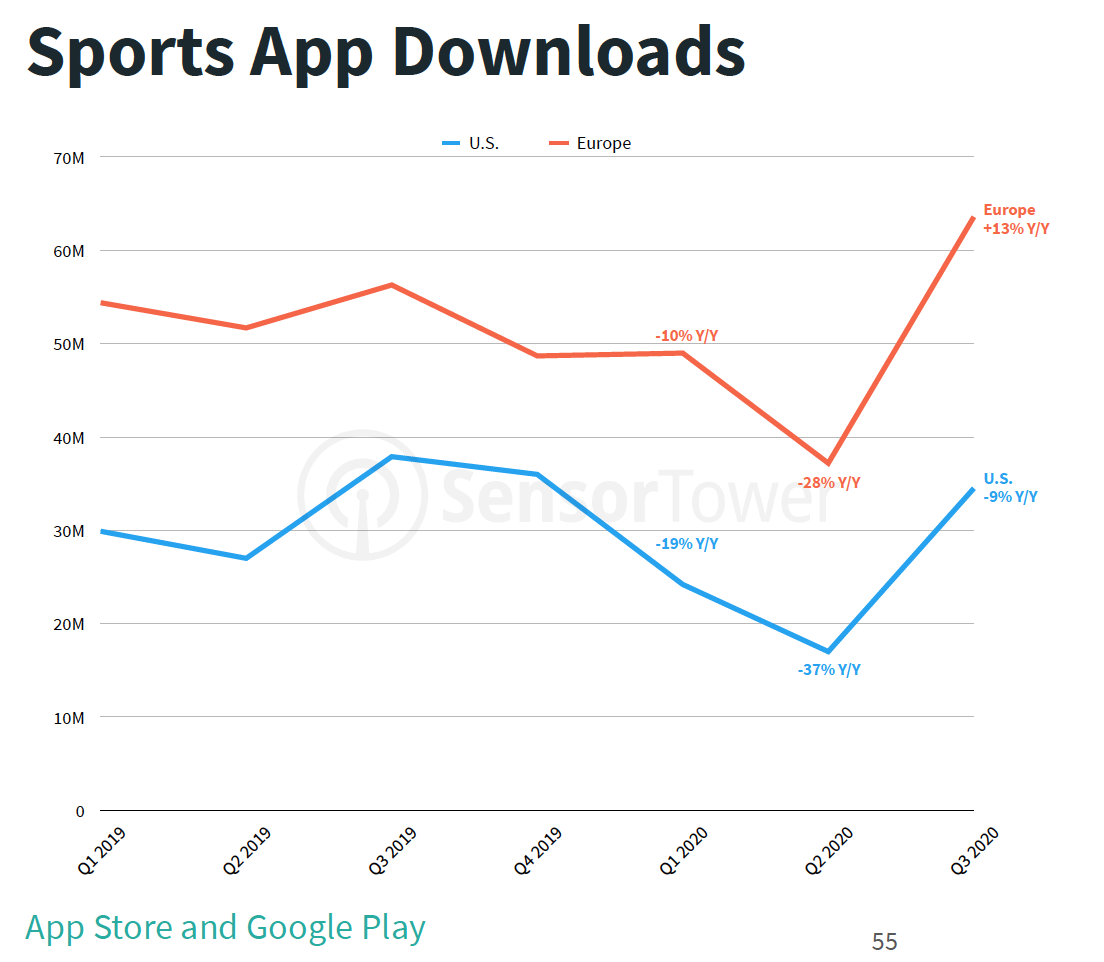

Sports also suffered. After a decline in Q1 and Q2, the return of sports activities in Q3 helped the sports category apps bounce back, with downloads for many top sports apps approaching near pre-COVID-19 levels again: Premier League surpassed 500K downloads in the UK, and ESPN matched its Q3 of 2019 downloads in the US.

It will take time for both industries to recover. In the meantime, mobile advertisers should continue to monitor mobile data movement – which can help them to tap into early consumer demand, identify key mobile feature updates, and gain an edge over the competition.

Happy holidays and happy new year from the Apptrust team!

Can we help you kick off 2021 successfully and achieve your mobile targets? Drop us a line at partners@apptrust.io if you’re looking for support on your performance marketing campaigns.

Author: Elizabeth Marchetti

apptrust